Hey, Guys Do you know about how the Internet was the first start-up. I’m getting the same vibe with this project.

What is Algorand?

- Algo is the native token of the Algorand Ecosystem.

- Algorand was Founded by Silvio Micali in 2017.

- The main net went live in 2019.

- Micali is an Italian Computer Scientist at MIT’s Computer Science and Artificial Intelligence Lab.

- And also he is a Professor at MIT in Electrical Engineering.

- And he won the Award for his fundamental contribution to the theory and practice of secure two-party computation, electronic cash, crypto, and blockchain protocols.

- He is a celebrity and expert in the crypto community.

- He is very well known for his contribution to Cardano and Ethereum blockchain technology.

How does ALGO Work?

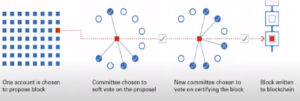

- Algorand’s Algo token is Proof of stake protocol.

- It uses Random users to verify transactions.

- This randomness adds an additional layer of security.

- Because of this even you have only one ALGO in your wallet you can earn interest on it by Staking.

- .

- So, how many users are using the network doesn’t matter.

- It supports a variety of applications more on the general-purpose side like Cardano or Polkadot.

- This means there are lots of apps that can build on this Platform.

- And it provides a platform for tokens, NFT’s, Stablecoins, finance tools, cost-effective payment infrastructure.

What is Algorand’s mission?

- Looks for Global trust through decentralization.

- Makes a simple design that drives adoptions by billions of people.

- Uses technology that eliminates barriers.

What is Algorand’s TPS(Transactions Per Second) Report?

- Algorand is very fast and efficient with a current speed of 1000 TPS.

- And has a 45 Second confirmation time.

- And transaction fee of less than $0.01 per transaction.

- when Compare to Ethereum has 5 minutes of confirmation time.

- And several dollars of fee per transaction and hopefully this will be fixed by polygon Matic Update.

Useability of Algorand

- Algorand can be developed with python, javaScript, and Golang.

- And these are generally considered easier languages to learn and use.

- Java also used, but a little harder to use and learn.

- Smart contracts can be written in python.

- When trying to run a node on Algorand supplies clear instruction online.

- System Requirements are fairly minimal.

- you don’t need an extremely fast internet connection or GPU.

- This really encourages new developers to use the Algorand platform.

How Does Algorand Work?

In cryptocurrency, you often hear about Layer’s (like for example Ethereum layer 2 solution Matic). This is a very smart way to make the blockchain more efficient and make it faster.

1.Layer 1 (ASC1).

- Used for processing tokens transactions. simple smart contracts that don’t require real-world information and any other processes that don’t require much time to execute.

Example:- Trading coin and Crowdfunding.

- Algorand uses a universal Architecture in this layer written in their programming language T.E.A.L(transaction execution approval language)

2. Layer 2 (off-chain).

- Used to process more complex smart contracts that need off-chain data and take longer to complete.

- when the “work” is done off-chain, however, once the process is complete the results are recorded on the public ledger.

- It only communicates with layer 1 after every step is fully completed.

What are the Applications For Algorand?

Possible use-cases for Algorand:

- Defi.

- Asset creations, digital securities, and asset management.

- identity management.

- Decentralized organization and voting.

- Supply chain, Internet of Things, and product verification.

What are the Partnerships for Algorand?

- Partnership with Meld Gold to Bring tokenized gold and silver to the platform.

- Partnership with Italian copyright agency SIAE to place copyright into the blockchain.

- Vest Equity Partnership to allow individuals to purchase, shares of real estate on the blockchain.

What are the Risks with ALGO?

Concerns that the pool Algorand uses to payout stakeholders will run out and it’s not clear what system they will follow and if transaction fees are enough to reward Stakeholders.

Where can I buy ALGO?

- Binance – ALGO/USDT, ALGO/USD

- Huobi Global – ALGO/USDT

- Crypto.com – ALGO/USDT

Leave a Reply