Image Source :https://coincodex.com/

TIA Coin Prediction 2023-2050, Celestia Coin is a digital currency that operates on the principles of decentralization, security, and efficiency. It is built on blockchain technology, which ensures transparency and immutability of transactions. The coin offers a wide range of benefits to its users, making it an attractive option for individuals and businesses alike.

One of the key advantages of Celestia Coin is its decentralized nature. Unlike traditional currency systems that are controlled by central banks, Celestia Coin operates on a peer-to-peer network. This means that transactions can be conducted directly between users without the need for intermediaries. This decentralized approach eliminates the need for trust in third parties and provides individuals with greater control over their financial transactions.

Another important feature of Celestia Coin is its focus on security. The blockchain technology used by Celestia Coin ensures that each transaction is securely recorded and verified by multiple participants in the network. This makes it virtually impossible for hackers or malicious actors to manipulate or alter the transaction history. Additionally, the use of cryptographic algorithms ensures that the identities of users remain anonymous, providing an extra layer of security and privacy.

Efficiency is also a key aspect of Celestia Coin. Traditional financial systems often involve lengthy processes and high fees for conducting cross-border transactions. With Celestia Coin, international payments can be made quickly and at a significantly lower cost. This is particularly beneficial for businesses that operate globally and need to transfer funds across borders frequently.

Furthermore, Celestia Coin offers a range of additional features that enhance its usability and functionality. For example, users can earn rewards by participating in the network through a process called staking. Stakers are rewarded with additional coins for holding and validating transactions on the blockchain. This incentivizes users to actively participate in the network, contributing to its security and stability.

In conclusion, Celestia Coin is a digital currency that offers numerous benefits to its users. Its decentralized nature ensures greater control and transparency over financial transactions, while its focus on security ensures the integrity of the system. Additionally, its efficiency and additional features make it a compelling option for individuals and businesses looking for a modern and secure form of currency.

How Celestia coin perform in the current market Think step-by-step.

To analyze the performance of Celestia Coin in the current market, we need to follow a step-by-step process. Here’s how we can approach it:

- Research the current market data: Start by gathering up-to-date market data on Celestia Coin, including its current price, trading volume, market capitalization, and price trends over different time periods. This data can be obtained from reliable cryptocurrency exchanges, market analysis websites, or financial news sources.

- Compare with historical data: Compare the current market data of Celestia Coin with its historical performance. Look at how the price has changed over time, any significant price fluctuations, and trading patterns. This comparison can help identify any notable trends or patterns that might be affecting the coin’s current performance.

- Analyze market sentiment: Explore the sentiment surrounding Celestia Coin in the market. Look for any recent news, announcements, partnerships, or events that might have influenced the market sentiment. Positive developments can create a bullish sentiment and attract more buyers, while negative news or events can lead to a bearish sentiment and contribute to a decline in the coin’s performance.

- Evaluate market demand: Assess the market demand for Celestia Coin. Consider factors such as user adoption, community engagement, and the coin’s utility or use cases. Higher demand for the coin indicates a positive outlook for its performance, while lower demand could hinder its market performance.

- Monitor overall market conditions: Take into account the broader cryptocurrency market conditions. Analyze the performance of other cryptocurrencies and observe any prevailing market trends. The overall market sentiment and trends can have a significant impact on the performance of individual coins, including Celestia Coin.

- Consider the development progress: Examine the technological advancements, updates, and ongoing development of Celestia Coin. Look for any recent improvements, partnerships, or new features that might increase the coin’s value and attractiveness. A robust and active development team can contribute to the positive market performance of the coin.

- Analyze trading volumes and liquidity: Evaluate the trading volumes and liquidity of Celestia Coin in the market. Higher trading volumes and liquidity indicate a more active market, making it easier to buy or sell the coin. Lower liquidity can result in wider spreads and limited trading opportunities, impacting the coin’s performance.

Image Source :https://coincodex.com/

By following these steps and analyzing the relevant factors, you can gain a better understanding of how Celestia Coin is performing in the current market. Remember that market performance is subject to change, and it is essential to regularly update your analysis to stay informed about the coin’s performance.

Celestia Price Prediction FAQ

What is the Celestia price forecast for tomorrow?

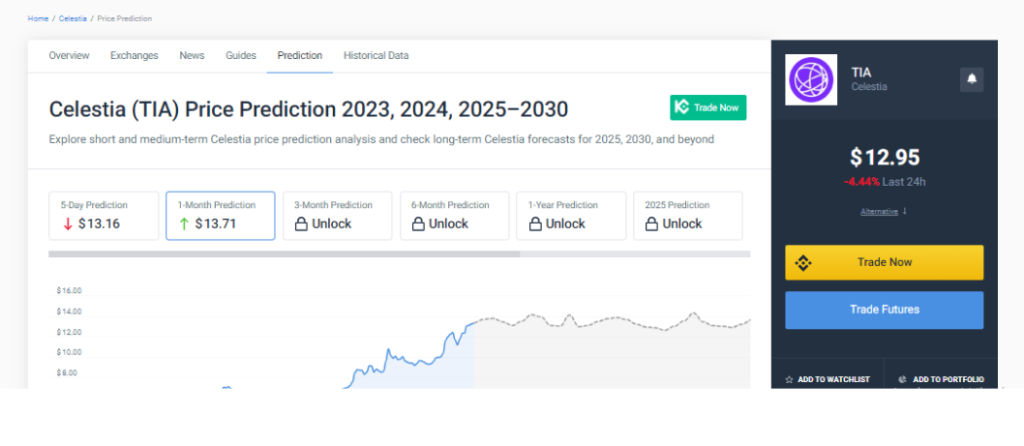

Celestia is expected to gain 0.00% and trade at $ 13.40 tomorrow.

What is this week’s Celestia price forecast?

This week, TIA is expected to trade between $ 13.40 and $13.76, according to our Celestia price projection. If Celestia meets the higher value target, it will rise by 2.73% to $ 13.76 by December 16, 2023.

What is the Celestia price forecast for the coming week?

Celestia’s price forecast for the coming week is between $ 13.76 on the low end and $ 13.16 on the high end. According to our TIA price prediction chart, the price of Celestia will fall by -4.34% and hit $ 13.16 by December 23, 2023 if the higher price target is met.

What will the Celestia price be in 2023?

Celestia is expected to trade between $ 13.03 and $ 14.21. If the higher price goal is met, TIA may rise by 4.32% to $ 14.21.

What is the Celestia price prediction for 2024?

Our Celestia price estimate indicates that TIA will likely trade between $12.51 and $17.33 in the upcoming year. Celestia will increase by 30.12% and reach $ 17.73 if it reaches the higher value target for 2024.

What will the Celestia price be in 2025?

Celestia’s price projection for 2025 is between $ 15.49 and $ 27.89 on the bottom end. According to our TIA price prediction chart, if Celestia reaches the upper price target, its price might rise by 104.72% to $ 27.89.

What is Celestia’s pricing forecast for 2030?

Celestia’s price projection for 2030 ranges from $ 24.29 on the low end to $ 30.75 on the high end. According to our TIA price prediction chart, if Celestia reaches the top price target, it might gain 125.66% and reach $ 30.75.

Is Celestia going to hit $100?

To get to$100, Celestia would have to increase by 633.93%. Our Celestia prediction algorithm predicts that in January 2041, Celestia will reach $100.

Is Celestia going to hit $1,000?

To hit $1,000, Celestia would need to increase by 7,239.29%. Our Celestia prediction system indicates that the product’s price will not approach $1,000. By January 1, 2049, the highest price our system predicts is $ 269.65.

Image Source :https://coincodex.com/

How does Celestia feel right now?

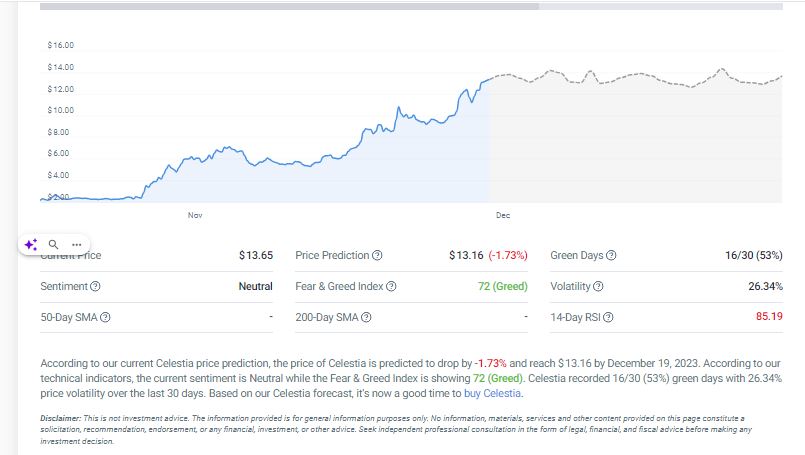

Based on our technical research, the attitude in Celestia right now is neutral.

Can you explain what the Celestia Fear & Greed Index means?

At 72, the Celestia Fear & Greed Index indicates that investors are currently feeling in the “greed zone.”

A number of market and financial indicators, such as 30- and 90-day volatility, trading volume, social media activity, and Google Trends data, are combined to create the Fear & Greed Index. The main source of information about Celestia investors’ sentiment is the Fear & Greed Index, which is based on market data pertaining to Bitcoin.

The market’s overall emotion is shown by the Fear & Greed Index, which ranges from 0 to 24 extreme fear, 25 to 49 fear, 50 neutral, 51 to 75 greed, and 76 to 100 extreme greed. While a strong positive mood may indicate a good time to sell, some traders view a strong negative sentiment as a good opportunity to buy.

Is investing in Celestia profitable?

Celestia experienced 16/30 (53%) green days in the previous 30 days. Our historical data indicates that investing in Celestia is beneficial right now.

How much will Celestia cost the following week?

Our Celestia prediction states that by December 19, 2023, the price of Celestia will have dropped by -1.73% during the course of the next week, to $ 13.16.

How much will Celestia cost in the upcoming month?

Our Celestia prediction states that by January 13, 2024, the price of Celestia will have increased by 2.34% during the course of the next month to $ 13.71.

What exactly is Celestia’s 14-day RSI and what does it mean?

The 14-day RSI for Celestia is 85.19, indicating that TIA is currently undervalued.

The RSI (Relative Strength Index) is a widely used technical indicator for analyzing the values of a wide range of assets, including Celestia. The RSI is most typically employed on a 14-day time frame. The RSI is used to measure market momentum. The RSI indicator produces readings ranging from 0 to 100, with 30 and 70 being critical levels. An RSI value less than 30 suggests that the asset is currently undervalued, whilst an RSI value greater than 70 indicates that the item is currently overvalued.

Will Celestia rise again?

According to our algorithmically derived Celestia price projection, the price of TIA is anticipated to fall by 2.34% in the next month and reach $ 13.71 on January 13, 2024. Furthermore, Celestia’s price is expected to rise 7.14% in the next six months, reaching $ 14.35 on June 11, 2024. Finally, Celestia is anticipated to trade at $ 17.73 on December 13, 2024, a 32.35% decline in value in one year.

How does our Celestia price forecast work?

On CoinCodex, the Celestia price prediction is derived using the historical Celestia price record, taking into account past volatility and market movements. Furthermore, the algorithm takes use of the cyclical structure of Bitcoin halvings, which provide further supply-side pressure to BTC every four years. This has historically played an important part in bitcoin markets and is an important component of developing a credible Celestia prediction.

Price Prediction Indicators for Celestia

Moving averages are one of the most widely utilized Celestia price prediction tools. A moving average, as the name implies, provides the average closing price for TIA for a given time frame, which is divided into a number of equal-length periods.

Traders utilize the exponential moving average (EMA) in addition to the simple moving average (SMA). The EMA gives more weight to current prices and hence reacts more quickly to recent price action.

Moving averages of 50, 100, and 200 days are some of the most widely used indicators in the cryptocurrency market for determining critical levels of support and resistance. A move above any of these averages in the TIA price is usually interpreted as positive news for Celestia.

Traders also like to utilize the RSI and Fibonacci retracement level indicators to predict the TIA price’s future direction.

How can Celestia charts be read to forecast price movements?

Candlestick charts are preferred by most traders because they provide more information than a standard line chart. Traders can observe candlesticks that indicate Celestia’s price action at several granularities, such as a 5-minute candlestick chart for extremely short-term price action or a weekly candlestick chart for identifying long-term patterns. The most common candlestick charts are 1-hour, 4-hour, and 1-day.

What factors influence Celestia’s price?

Supply and demand affect Celestia’s price just like they do any other asset. Fundamental occurrences like hard forks, new protocol changes, or block reward halvings can have an impact on these dynamics. The price of TIA may also be impacted by laws, acceptance by businesses and governments, hacking of cryptocurrency exchanges, and other actual occurrences. Celestia’s market capitalization is subject to abrupt fluctuations in value.

Many traders attempt to foresee Celestia by keeping an eye on the activities of TIA “whales,” or groups of people and organizations that possess significant TIA holdings. “Whales” can exert a significant influence on Celestia’s price changes on their own because the market is smaller than traditional marketplaces.

FAQ

Q: What factors are considered for predicting the price of Celestia (TIA) in 2023 and 2024?

A: Several factors are considered for predicting the price of Celestia (TIA) in 2023 and 2024. These factors include market analysis, historical data analysis, fundamental analysis, adoption rate, competition, industry developments, and any specific news or events related to Celestia.

Q: Can historical data be used to predict the price of Celestia (TIA) in 2023 and 2024?

A: Yes, historical data can be analyzed to identify patterns or trends that may help predict the price of Celestia (TIA) in 2023 and 2024. By looking at past price movements and technical indicators, analysts can make informed predictions about future price movements.

Q: What is fundamental analysis and how does it impact the price prediction of Celestia (TIA)?

A: Fundamental analysis involves evaluating the underlying factors that can impact the price of Celestia (TIA). This analysis assesses the project’s technology, team, partnerships, roadmap, community, and other fundamental aspects. By considering these factors, analysts can gauge the long-term potential of Celestia and its impact on price prediction.

Q: Are there any specific events or news that may influence the price of Celestia (TIA) in 2023 and 2024?

A: Yes, specific events or news related to Celestia can have a significant impact on its price. These events can include major partnerships, product launches, regulatory developments, and market trends. Tracking and analyzing such events can provide insights into how the price of Celestia (TIA) may be influenced in the future.

Please note that price predictions are speculative in nature and should not be considered as financial advice. They are based on historical data, trends, and factors at a given point in time. It’s important to conduct thorough research and consider multiple sources of information before making any investment decisions.

0